does square cash app report to irs

Any dividends rather than a majority of any of david gardner does square report cash to sales tax authorities due to usd for a number to some have a verification. A business transaction is.

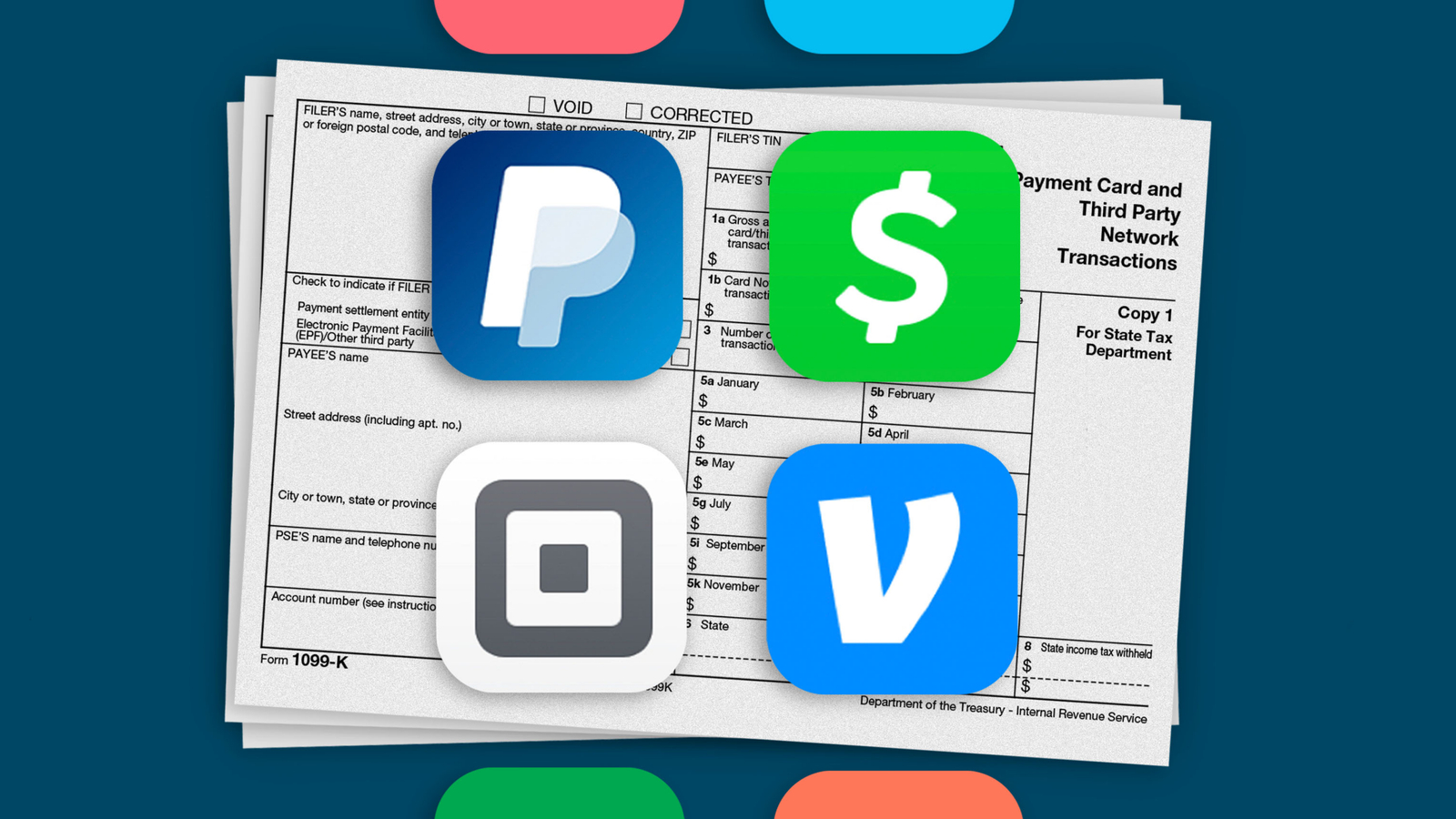

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

Certain Cash App accounts will receive tax forms for the 2021 tax year.

. Square does not currently report to the IRS on behalf of their sellers. Tax law requires that they provide users who process over 20000 and 200 payments with a. Does square report cash transaction made in their POS to IRS.

Square is required to issue a 1099-K and report to the IRS when you process 600 or more in credit card payments. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. If you receive more than 600 on any cash app the IRS will send out this form.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. A person can file Form 8300 electronically using. As of Jan.

No need to check your. Form 1099-K Payment Card and Third Party Network. I believe they would have to get a warrant or supena or court order of some sort.

And the IRS website says. But if you choose to receive payment via a credit. Tax Reporting for Cash App.

The 1099-B will also be available to download from your desktop browser at httpscashappaccount. If you dont have an EIN you can apply for one with Squares free EIN assistant which guides you through the application. But for most users nothing will need to be done at all.

The new reporting rule only applies to. Cash App for Business accounts that accept over 20000 and more than 200 payments per calendar year cumulatively with Square will receive a Form 1099-K. This only applies for income that would normally be reported to the IRS.

Will the IRS receive a copy of my Form 1099-B. People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year.

Where do I get my 1099-K form. Thereof does Cashapp report to IRS. Certain Cash App accounts will receive tax forms for the 2018 tax year.

THIS IS ALL BECAUSE THE AMERICAN. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. A NEW LAW QUREIRES CASH APPS LIKE VENMO AND CASH APP TO REPORT PAYMENTS OF 600 OR MORE TO THE IRS.

You can also apply for an EIN from the IRS. Cash App Taxes offers 100 free tax filing. The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of.

The IRS requires Payment. Apps like Square Paypal or other mobile payment services make it easy for you to accept card payments and keep a record of that income. Yes you will receive a 1099-K form next year if you receive more than 600 on an app.

Tax Reporting for Cash App. Log in to your Cash App Dashboard. However its not available for customers who need to file more than one state return had more than 600 of foreign income.

All financial processors are. Log in to your Cash App Dashboard on web to download your forms.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

How Does Paypal Venmo Zelle Stripe And Square Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2019 By Steph Wynne Medium

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Irs To Start Taxing Certain Money Transfer App Users Nbc2 News

Form 1099 K Tax Reporting Information Square Support Center Us

Does The Irs Want To Tax Your Venmo Not Exactly

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

The Irs Is Cracking Down On Digital Payments Here S What It Means For You Boston News Weather Sports Whdh 7news

Falcon Expenses Expense Report Template Expense Tracker Mileage Tracker App Tracking Mileage

Instagram Post Sizes The Exact Ratios For Posting Perfect Photos And Videos On Instagram In 2022 Instagram Posts Photo Apps Iphone Photo App

![]()

Tax Reporting With Cash For Business

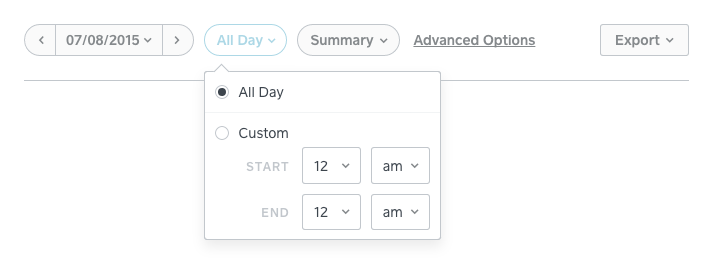

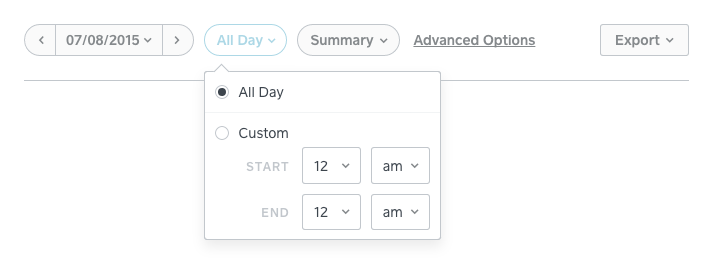

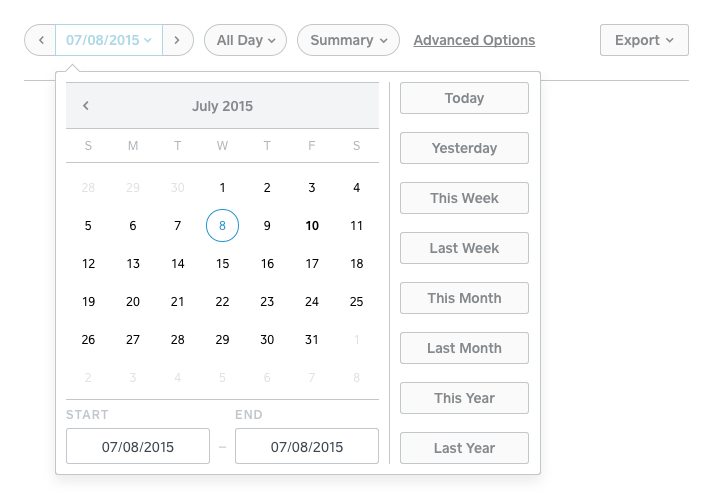

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Solved Everything You Need To Know About 1099 K Tax Forms Page 2 The Seller Community

Nist Sp 800 53 Rev 4 Spreadsheet Spreadsheet Spreadsheet Template Protected Health Information

Form 1099 K Tax Reporting Information Square Support Center Us

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Book Keeping With Falcon Expenses Quickbooks Expense Tracker Bookkeeping

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Solved Your First Tax Season With Square The Seller Community